Company information for Begbies Traynor Group investors

A leading UK advisory firm with multi-disciplinary professional teams

We provide advice and solutions to our clients to enhance, protect and realise the value of their businesses, assets and investments across the following areas of expertise

Business Recovery

- Corporate insolvency

- Contentious Insolvency

- Personal Insolvency

- Creditor Services

Advisory and Corporate Finance

- Debt Advisory and Finance Broking

- Special Situations M&A

- Corporate Finance

- Financial Advisory

Valuations

- Property

- Businesses

- Assets

- Loan Security

Asset Sales

- Property Auctions

- Commercial Property Agency

- Plant and Machinery Auctions

- Business Sales Agency

Property Consultancy

- Building Consultancy

- Commercial Property Management

- Transport Planning

- Insurance and Protection

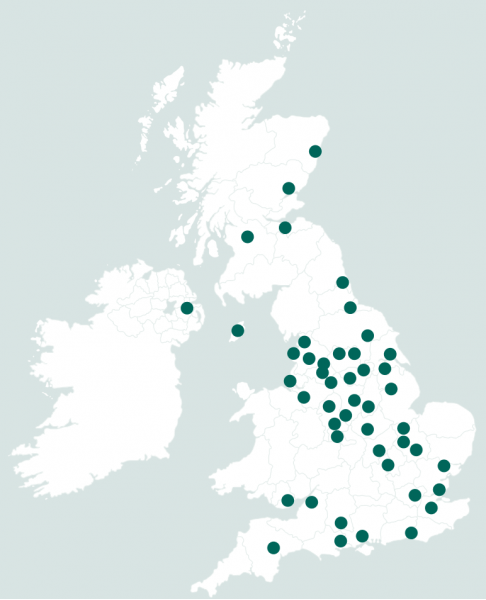

Where we operate

We operate within business communities from offices across the UK and selected offshore locations.

Corporate and personal insolvency

We handle the largest number of corporate appointments in the UK, principally serving the mid-market and smaller companies.

Valuations

Valuation of property, businesses, machinery and business assets.

Corporate finance

Buy and sell side support on corporate transactions.

Transactional services

Sale of property, machinery and other business assets through physical and online auctions; business sales agency; commercial property agency.

Financial advisory

Debt advisory, due diligence and transactional support, accelerated corporate finance, pensions advisory, business and financial restructuring, forensic accounting and investigations, finance broking.

Property consultancy, planning and management

Building consultancy, lease advisory, commercial property management, specialist insurance and vacant property risk management, transport planning and design.

Our strategy

The board believes the execution of this strategy will enhance shareholder value through the delivery of strong and sustainable financial performance.

Our strategic objectives

Increase Scale And Quality

Increase the scale and quality of our businesses both organically and by acquisition

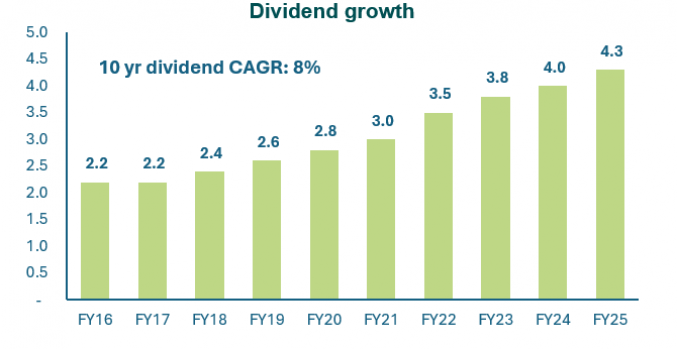

Shareholder Value

Deliver sustainable profitable growth, enabling increased shareholder value

Effective Capital Structure

Maintain our strong financial position, enabling the investment in and development of the group and our people

Strong Corporate Governance

continue to ensure high standards of corporate governance and responsibility

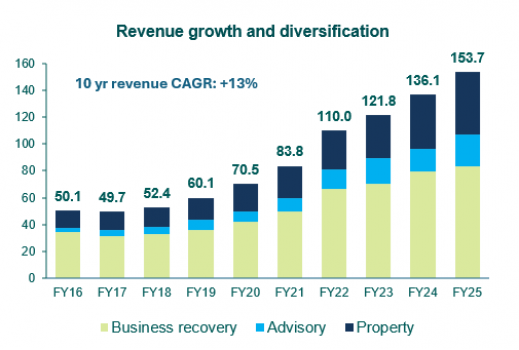

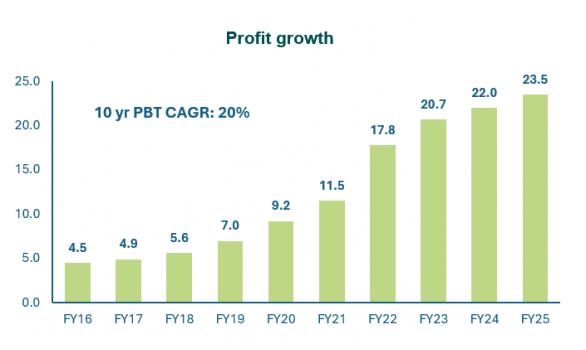

Ten years of profitable growth across the cycle

Our strategy

The board believes the execution of this strategy will enhance shareholder value through the delivery of strong and sustainable financial performance.

Organic growth strategy

Organic growth will be targeted through:

- retention and development of our existing partners and employees

- recruitment of new talent

- enhanced cross-selling of our service lines and expertise to our wider client base

- investment in technology and processes to enhance working practices and improve the service to our clients

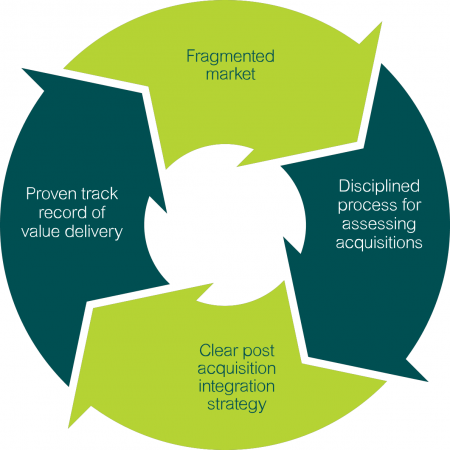

Acquisition strategy

Our acquisition strategy is to target earnings-accretive acquisitions in either:

- existing service lines to enhance expertise or geographical coverage

- complementary professional services businesses to continue the development of the group and its service offerings